Silence Intelligence- How Modern B2B Teams Turn Quiet Pipelines into Revenue Signals

A field guide for GTM leaders on measuring, interpreting, and acting on buyer silence so rev teams stop guessing and start recovering stalled revenue.

Silence Intelligence: How Modern B2B Teams Turn Quiet Pipelines into Revenue Signals

The healthiest revenue engines no longer treat buyer silence as “no response.” They treat it as telemetry. Silence intelligence is the operating discipline of measuring absence of activity, attributing it to real-world causes, and triggering coordinated actions before competitors even know the deal is thawing.

This playbook distills what enterprise GTM teams are doing in 2026 to engineer silence-aware motions—from data models through SDR workflows—so you can roll the same approach into your own revenue operating system.

1. Define Silence as a Measurable Signal

Silence is not a feeling; it is a gap between expected and actual engagement. Align CS, RevOps, and sales leadership on a shared taxonomy:

- Engagement SLA – How long can a stage sit inactive before it’s flagged? (e.g., 9 days in Evaluation, 4 days post-legal feedback.)

- Signal weightings – Which dormant behaviors matter most? Opened but no reply, no meetings scheduled, product trial not touched, etc.

- Risk tiers – “Watch,” “Intervene,” and “Escalate” bands that trigger different motion playbooks.

Once codified, pipe these definitions into your data warehouse and CRM so every lead, contact, and opportunity automatically receives a silence score.

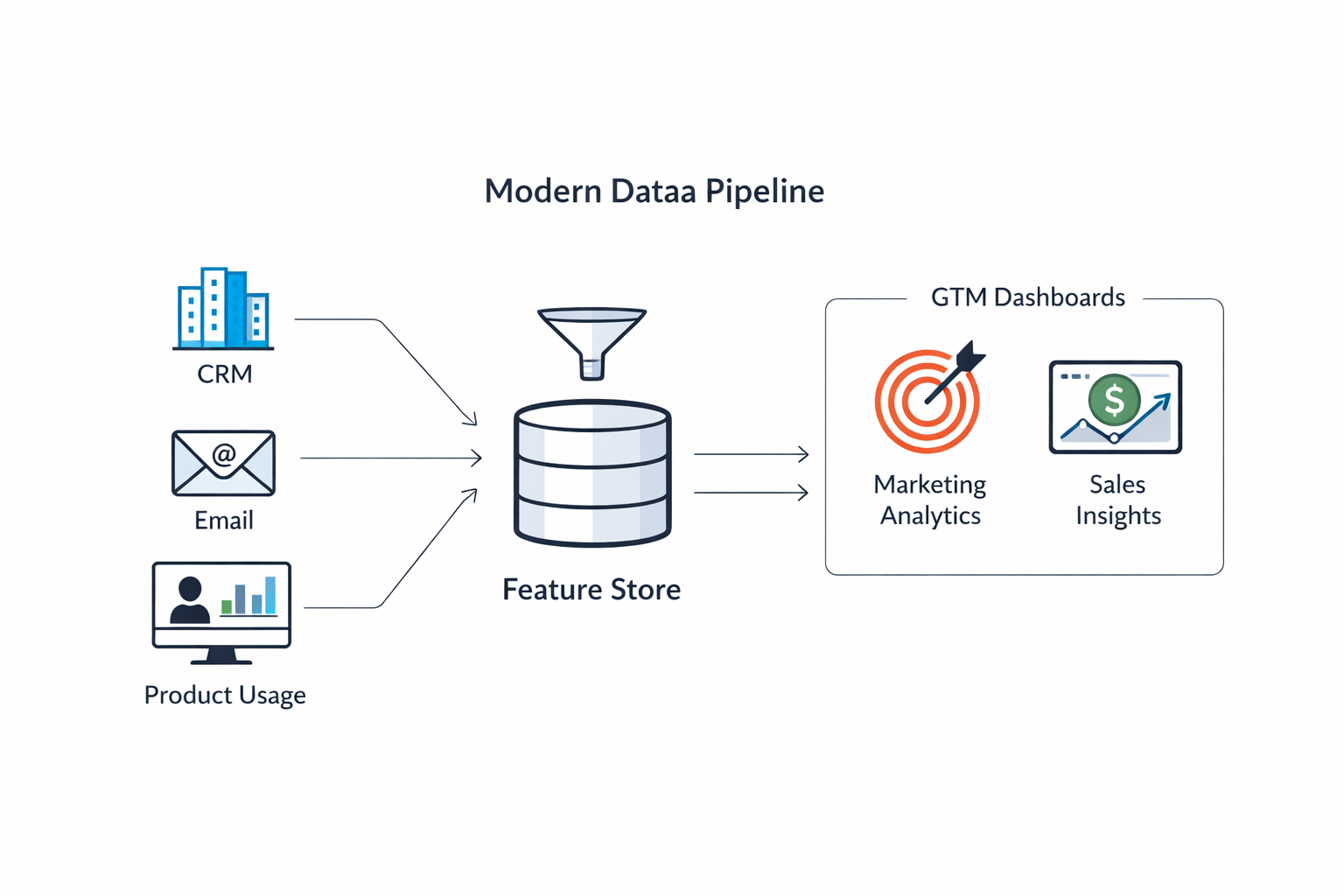

2. Instrument the Data Backbone

Silence intelligence rises and falls with telemetry quality. Build a unified dataset over three domains:

1. Inbox telemetry – Email sends, opens, replies, time-to-open, sequences used.

2. Revenue ops activity – Calls, meetings, mutual action plans, pipeline stage progression.

3. External context – Job changes, funding rounds, seasonal budget cycles, site visits.

Feed these into a feature store the GTM team can query. Analysts can now answer: “Which closed-lost deals reactivated after leadership turnover?” or “How fast do we get replies when we involve product in late-stage?”

3. Operationalize Silence Reviews

Create a cadence where silence is discussed with the same rigor as bookings:

- Weekly “quiet pipeline” standup (20 min): SDR leader, AE manager, RevOps. Review top silent opportunities, assign interventions, log expected outcomes.

- Executive dashboard: Silence coverage, intervention velocity, recovered ARR. CFOs want this to validate headcount and tooling.

- Post-mortem on revives: When a formerly silent deal closes, backtrack which signals predicted movement and which playbook worked. Feed learnings back into your models.

4. Build AI-Coached Touches, Not AI-Spam

AI should assist, not replace, the humans on the account:

- Draft assist: AI assembles the email from context—stall reason, personas involved, last asset shared—and proposes two variations aligned to the silence tier.

- Suggested timing: Models recommend the send window most likely to get a response based on historical reply curves from that company or industry.

- Escalation guardrails: If legal has gone dark, the AI recommends a consequence-based CTA; if economic buyer stalled, it suggests an executive-to-executive nudge with mutual success metrics.

> Measure AI effectiveness by reply uplift and cycle acceleration, not raw email volume.

5. Orchestrate Plays Across Functions

Silence intelligence is cross-functional. Mature teams run plays that involve enablement, product, and customer marketing:

- Product-sourced insight drops when usage telemetry shows a plateau.

- Customer marketing air-cover coinciding with SDR follow-ups—case studies, webinar invites, ROI calculators tailored to the silent account’s industry.

- Exec sponsor interventions triggered when C-level relationships go quiet beyond the agreed SLA.

Document these plays in a RevOps playbook with owners, SLAs, example messaging, and links to templates.

6. Report Silence Like a Board Metric

Silence intelligence is most powerful when it influences executive decisions:

- Track Silence-Caused Slippage: $ value delayed beyond expected close due to inactivity.

- Monitor Recovered ARR: Pipeline revived via silence-triggered plays.

- Present Intervention Velocity: Median hours between silence trigger and human follow-up.

Boards respond to quantified leaks tied to specific interventions. When you can show that a 48-hour reduction in intervention velocity yielded $1.2M in revived pipeline, headcount and tooling conversations become much easier.

7. Getting Started Next Week

1. Align GTM leaders on definitions and risk tiers.

2. Instrument inbox and CRM data into a single silence score (start simple).

3. Stand up a 30-minute weekly silence review with three critical plays documented.

4. Pilot AI-drafted follow-ups on a subset of stalled opps, measuring reply lift.

5. Report silence metrics to your exec team within 30 days.

> Momentum comes from cadence, not complexity. Ship an imperfect dashboard next week; perfect it once the team is acting on the insights.

Additional Resources

- Silence Signal Definitions Template (FigJam) – Map stages, owners, and triggers.

- Intervention Playbook Spreadsheet – 12 plays with suggested assets, owners, and SLAs.

- Executive Readout Slide Deck – Silence metrics formatted for board updates.

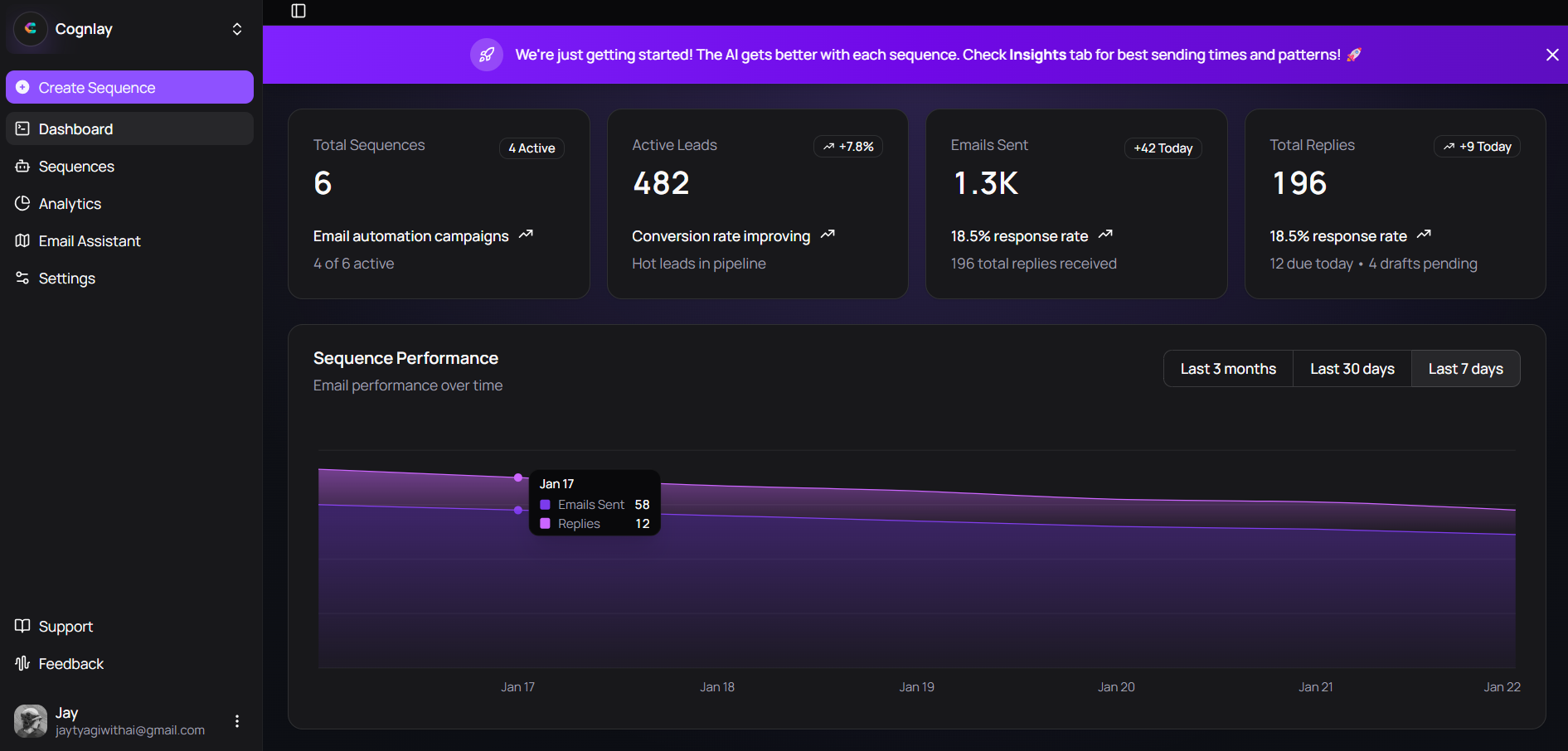

Bring Silence Intelligence to Cognlay

Cognlay ingests your email, CRM, and product signals, then recommends the highest-impact follow-ups so every AE knows the next best move. Book a working session with our revenue architects and install silence intelligence in your GTM stack in under 30 days.